Time Series > Unit Root

What is “Unit Root”?

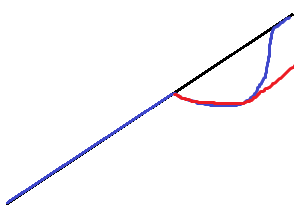

A unit root (also called a unit root process or a difference stationary process) is a stochastic trend in a time series, sometimes called a “random walk with drift”; If a time series has a unit root, it shows a systematic pattern that is unpredictable.

The Mathematics Behind Unit Roots

The reason why it’s called a unit root is because of the mathematics behind the process. At a basic level, a process can be written as a series of monomials (expressions with a single term). Each monomial corresponds to a root. If one of these roots is equal to 1, then that’s a unit root.

If you’re analyzing time series, these roots can cause your analysis to have serious issues like:

- Spurious regressions: you could get high r-squared values even if the data is uncorrelated.

- Errant behavior due to assumptions for analysis not being valid. For example, t-ratios will not follow a t-distribution.

What is a Unit Root Test?

These are tests for stationarity in a time series. A time series has stationarity if a shift in time doesn’t cause a change in the shape of the distribution; unit roots are one cause for non-stationarity.

These tests are known for having low statistical power. Many tests exist, in part, because none stand out as having the most power. Tests include:

- The Dickey Fuller Test (sometimes called a Dickey Pantula test), which is based on linear regression. Serial correlation can be an issue, in which case the Augmented Dickey-Fuller (ADF) test can be used. The ADF handles bigger, more complex models. It does have the downside of a fairly high Type I error rate.

- The Elliott–Rothenberg–Stock Test, which has two subtypes:

- The P-test takes the error term’s serial correlation into account,

- The DF-GLS test can be applied to detrended data without intercept.

- The Schmidt–Phillips Test includes the coefficients of the deterministic variables in the null and alternate hypotheses. Subtypes are the rho-test and the tau-test.

- The Phillips–Perron (PP) Test is a modification of the Dickey Fuller test, and corrects for autocorrelation and heteroscedasticity in the errors.

- The Zivot-Andrews test allows a break at an unknown point in the intercept or linear trend.

References

Kotz, S.; et al., eds. (2006), Encyclopedia of Statistical Sciences, Wiley.

Everitt, B. S.; Skrondal, A. (2010), The Cambridge Dictionary of Statistics, Cambridge University Press.

Vogt, W.P. (2005). Dictionary of Statistics & Methodology: A Nontechnical Guide for the Social Sciences. SAGE.