The concept is important in time series, where correlation coefficients between two series only have meaning if both series are covariance stationary. When a series isn’t covariance stationary, any estimations from the model will have no economic meaning (Defusco, 2015).

How Do I Know if My Series is Covariance Stationary?

In a time series, a variable is covariance stationary if the following are true (Watsham & Parramore, 1997):

- The expected value E(Xt), is a finite constant for all t,

- variance (σ2} is a finite constant for all t,

- The correlation coefficient between Xt and Xt – n is equal for all t.

In addition, the covariance of the time series with itself must be constant and finite for all fixed numbers of past or future periods (DeFusco, 2015).

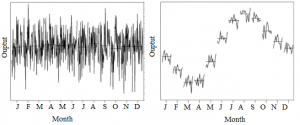

In general, you should be able to see if your time series has constant mean and variance by plotting it. In addition, you’ll want to perform a Augmented Dickey Fuller test for a unit root. A unit root is a stochastic trend in a time series, a “random walk with drift” that gives unpredictable patterns. If your model fails the ADF test, then your process isn’t covariance stationary.

Related article: What is a Stationary Sequence?

References

DeFusco, R. et al., (2015). Quantitative Investment Analysis, Wiley.

Pourahmadi, M. (2001). Foundations of Time Series Analysis and Prediction Theory. Wiley.

Watsham, T. & Parramore, K. (1997). Quantitative Methods in Finance. International Thomson Business Press.